Improve ROE & Improve Balance Sheet Efficiency

Hokuetsu is heavily invested in its competitor, Daio Paper. However, the two companies have a hostile relationship, making it impossible to derive synergies from the investment.

Daio Paper has outperformed Hokuetsu by 44.0% over the past 5 years and we believe the Company should exit from its investment in Daio Paper.

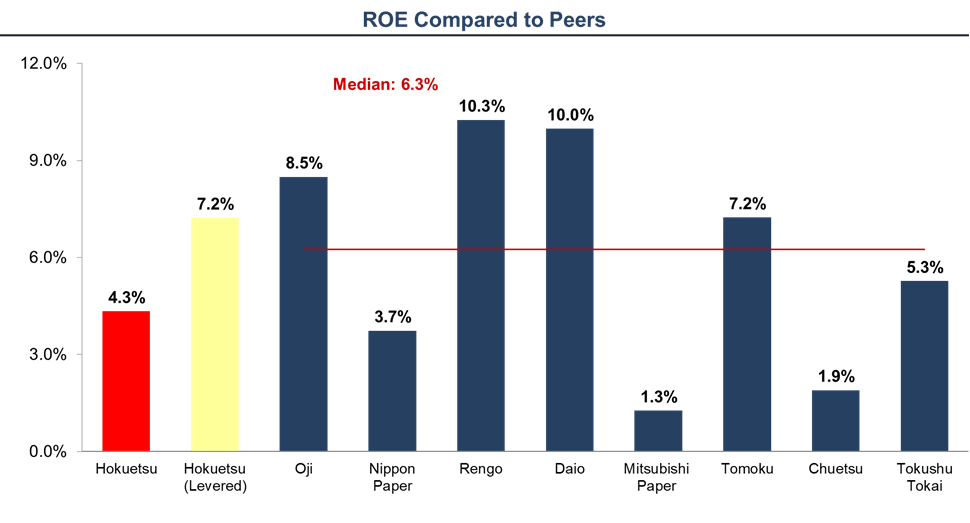

Moreover, Hokuetsu’s investment in Daio Paper does not generate a cash return. The dividend yield of Daio Paper is extremely low at 0.8%, which is lower than Hokuetsu’s ROE of 4.3%, and the 8.0% ROE target set as the minimum target in the Ito Report published in 2014. It is even lower than the median dividend yield of Hokuetsu and its competitors. If the Company resolves the shareholding in Daio and uses the cash to invest in its core business, the ROE improvement would be massive.

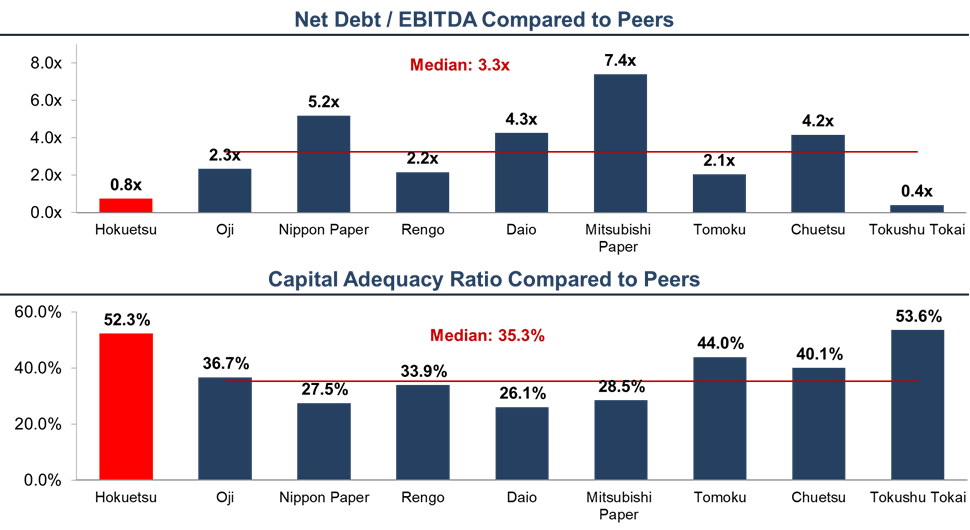

Hokuetsu has the strongest balance sheet among peers, and we believe the Company could use more leverage in the form of a corporate bond or bank loan.

Hokuetsu’s ROE lags its peers. If Hokuetsu utilized leverage, its ROE would increase to 7.2%.