Focus on the Biomass Power Plant Business as the Next Growth Driver

Corporates across the world are increasing their use of renewable energy. From Apple, Amazon, and Coca Cola, all the way to iron ore driller Fortescue, more companies are going carbon neutral. This is happening in Japan as well, where the Ministry of Economy, Trade and Industry (“METI”) intends to double the production from energy biomass power plants by 2030.

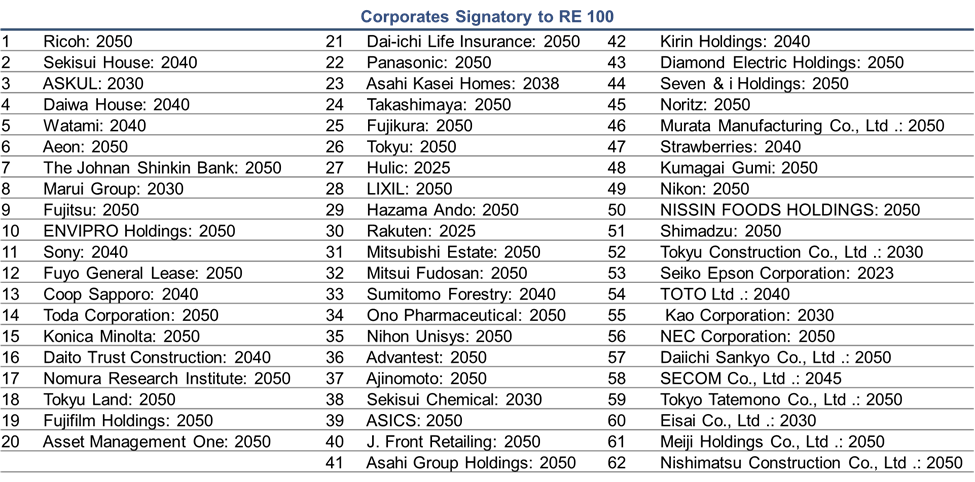

Sixty-two Japanese companies have joined as members of RE100, a global initiative for businesses that commit to transitioning to 100% renewable energy. Top Japanese manufacturing companies such as Sony, Fujitsu, Fujifilm, Panasonic, and more are aiming to use 100% renewable energy in 2040-2050, which creates a huge opportunity to sell renewable energy.

Hokuetsu has been slow to adapt to the growing paperless trend, which has been accelerated by COVID-19. Currently, they are trying to enter into the growth areas within the paper industry: container board and sanitary paper. However, there is massive competition in these areas already.

We believe the Company should focus its resources on expanding the biomass power plant business. With government and corporate policies encouraging the transition to carbon neutrality, we believe the IRR of the biomass power plant business will exceed 15%. Hokuetsu is in a prime position to capitalize on it. The Company already has relationships with wood chip producers and already has a port to import those wood chips. Hokuetsu has been invested in biomass power plants since 2006. The benefits of the energy business to competitor Nippon paper Industries Co., Ltd. (“Nippon Paper”) are clear, generating stable profit, even during the tough business environment under COVID-19.

Since it is easy to finance the biomass power plant business utilizing debt (at an interest rate of 0.7% or 0.8%), we believe investing in the biomass power plant business would increase the ROE of the Company massively.

The Company has been heavily invested in Daio Paper Corporation (“Daio Paper”) shares. However, we believe investing in the biomass power plant business is a better option.

As renewable energy corporates trades at a premium in the stock market, we believe investing in the biomass power plant would expand the multiple applied to Hokuetsu.

If Hokuetsu successfully invests in biomass power plant business, we believe Hokuetsu could be worth JPY534bn, which is 322% higher than what Hokuetsu is worth now.

Focusing the business on biomass power plants is in line with Hokuetsu’s corporate philosophy:

“As a people focused business group, we work to improve society globally, by providing socially and environmentally responsible products through innovative manufacturing on a global scale”

We urge Hokuetsu to use this opportunity to act now, as biomass power plant projects typically take several years to launch.